| | Sun Park,Executive Vice President and Chief Financial Officer Mr. Cancelmi, 58,Park, 48, was appointed Tenet’s Chief Financial Officer in September 2012January 2024 and Executive Vice President in March 2019. HeJuly 2023. Mr. Park previously served as Senior Vice President from April 2009, Principal Accounting Officer from April 2007 and Controller from September 2004. Mr. Cancelmi was a Vice President and Assistant Controller at Tenet from September 1999 until his promotion to Controller. He joined the Companyserved as Chief Financial Officer of Hahnemann University Hospital. Prior to that, he held various positions at PricewaterhouseCoopers, in the Pittsburgh office and in the firm’s National Accounting and SEC office in New York City. Mr. Cancelmi is a certified public accountant licensed in the states of Florida and Texas who received his bachelor’s degree in accounting from Duquesne University in Pittsburgh. He is also a member of the American and Florida Institutes of Certified Public Accountants and the Texas Society of Certified Public Accountants. Howard B. Hacker,Executive Vice President and Group Chief ComplianceFinancial Officer

for Pharmaceutical Distribution and Strategic Global Sourcing of AmerisourceBergen Corporation (“AmerisourceBergen”), a global pharmaceutical sourcing and distribution services company, beginning in September 2018. From 2012 to September 2018, Mr. Hacker, 49,Park was appointed Tenet’s Chief Compliance Officer in May 2016 and Executive Vice President in March 2019. In this capacity, he is responsible for overseeing the ethics and compliance programs for the Tenet enterprise, reporting directly to the Quality, Compliance and Ethics Committee of Tenet’s board of directors. Mr. Hacker previously held the title of Senior Vice President from May 2016 to February 2019. Mr. Hacker joined Tenet after more than a decade at Pfizer Inc., where he had served in various legal and compliance leadership positions since May 2004. Prior to Pfizer, Mr. Hacker worked for the law firms of Jones Day and Akin Gump Strauss Hauer & Feld, where he specialized in securities law and mergers and acquisitions. Mr. Hacker earned his law degree from the University of Texas at Austin and his bachelor’s degree in Russian and history from Washington University in St. Louis. Marie Quintana,Executive Vice President of CommunicationsStrategy and Chief Marketing Officer

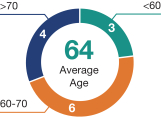

Ms. Quintana, 64, was appointed Tenet’s Chief Marketing OfficerDevelopment for AmerisourceBergen. Before joining AmerisourceBergen, Mr. Park served in May 2018various leadership roles across corporate development, corporate strategy and Executive Vice PresidentR&D portfolio management at MedImmune, the global biologics division of CommunicationsAstraZeneca. Before joining MedImmune, he held positions at Charterhouse Group International and Merrill Lynch & Company. He earned a Bachelor of Arts in March 2019. Ms. Quintana previously held the title Senior Vice President, CommunicataionsEconomics and a Bachelor of Arts in Biochemistry from July 2018 to February 2019. Under her leadership, Tenet activated its first integrated national marketing campaign, driving strong results in brand recognition and awareness. She also serves as chair of the Tenet Healthcare Foundation and is a director on the Governing Board of the Detroit Medical Center, which is operated by Tenet. Prior to joining Tenet, Ms. Quintana spent 14 years at PepsiCo where she held the positions of Senior Vice President of Sales and Marketing from March 2005 to April 2012, Vice President of Global IT

| | | | | | | 26 | |  | | | | |

Executive Officers

Strategy from July 2003 to March 2005, and Vice President of Technology from October 1998 to July 2003. Ms. Quintana earned her bachelor’s degree from Louisiana State University and her master’s degree from Tulane University. She co-founded the PepsiCo Women of Color Alliance, which was awarded the Catalyst Award in 2007. She is a past founding board member of the Network of Executive Women and previously served on the Board of Catholic Charities of Dallas. She has also been named one of the Top 50 Hispanic Women in Business by Hispanic Business Magazine and one of the Top 50 Women in Grocery by Progressive Grocer. She currently serves on the board of directors for Fetch Rewards, Inc.

| | | | | | | Securities Ownership2024 PROXY STATEMENT

Securities Ownership of Management

The table below discloses the shares, options and other securities beneficially owned by our directors and director nominees, each of our NEOs, and our current directors and executive officers as a group, as of March 15, 2021 (unless indicated below otherwise)

| | 39 |

Securities Ownership Securities Ownership of Management The table below discloses the shares, options and other securities beneficially owned by our directors and director nominees, each of our named executive officers (NEOs), and our current directors and executive officers as a group, as of March 1, 2024 (unless otherwise indicated below). No director or current executive officer has pledged any shares of our common stock. | | | | | | | | | | | | | | | | | | | Name | | Shares Beneficially Owned(1) | | | Shares of

Common Stock(2) | | Shares Underlying

Options/RSUs Exercisable Within 60 Days of

March 1, 2024 | | Percent of Class as of March 1, 2024 | | | | | Saumya Sutaria, M.D. | | | | 496,521 | | | | | -0- | | | | | * | | | | | | Vineeta Agarwala, M.D., PhD | | | | 1,562 | (3) | | | | -0- | | | | | * | | | | | | Paola M. Arbour | | | | 47,971 | | | | | -0- | | | | | * | | | | | | Thomas W. Arnst | | | | 8,148 | | | | | -0- | | | | | * | | | | | | James L. Bierman | | | | 53,720 | (4) | | | | -0- | | | | | * | | | | | | Roy Blunt | | | | 2,798 | (5) | | | | -0- | | | | | * | | | | | | Daniel J. Cancelmi | | | | 515,443 | | | | | 61,383 | | | | | * | | | | | | Richard W. Fisher | | | | 20,127 | (6) | | | | -0- | | | | | * | | | | | | Meghan M. FitzGerald, DrPH | | | | 35,269 | (7) | | | | -0- | | | | | * | | | | | | Lisa Y. Foo | | | | 19,566 | | | | | -0- | | | | | * | | | | | | Cecil D. Haney | | | | 14,535 | (8) | | | | -0- | | | | | * | | | | | | J. Robert Kerrey | | | | 60,725 | (9) | | | | -0- | | | | | * | | | | | | Christopher S. Lynch | | | | 25,620 | (10) | | | | -0- | | | | | * | | | | | | Richard J. Mark | | | | 47,303 | (6) | | | | -0- | | | | | * | | | | | | Sun Park | | | | -0- | | | | | 20,707 | (11) | | | | * | | | | | | Tammy Romo | | | | 61,280 | (12) | | | | -0- | | | | | * | | | | | | Stephen H. Rusckowski | | | | 3,682 | (13) | | | | -0- | | | | | * | | | | | | Nadja Y. West, M.D. | | | | 31,462 | (14) | | | | -0- | | | | | * | | | | | | Current executive officers and directors as a group (17 persons)(15) | | | | 930,289 | (16) | | | | 20,707 | | | | | 0.93 | % |

| (1) | Except as indicated, each individual named has sole control as to investment and voting power with respect to the securities owned. |

| (2) | As noted below, the totals in this column for each non-employee director include RSUs granted under the terms of our stock incentive plans. These RSUs are settled in shares of our common stock.stock either upon termination of service or upon the third anniversary of the date of grant. |

| | | | | | | | | | | | | | | | | | Name | | Shares Beneficially Owned(1) | | Shares of Common Stock(2) | | Options

Exercisable Within

60 Days of March 15, 2021 | | Percent of Class

as of

March 15, 2021 | Audrey Andrews | | | | 65,545 | | | | | 56,626 | | | | | * | | Paola Arbour | | | | 9,029 | | | | | -0- | | | | | * | | James L. Bierman | | | | 42,242 | (3) | | | | -0- | | | | | * | | Daniel J. Cancelmi | | | | 362,000 | | | | | -0- | | | | | * | | Richard W. Fisher | | | | 41,825 | (4) | | | | -0- | | | | | * | | Meghan M. FitzGerald | | | | 36,021 | (5) | | | | -0- | | | | | | | Cecil D. Haney | | | | 3,057 | (6) | | | | -0- | | | | | * | | Sandra R.A. Karrmann | | | | 8,309 | (7) | | | | -0- | | | | | * | | J. Robert Kerrey | | | | 75,769 | (8) | | | | -0- | | | | | * | | Christopher S. Lynch | | | | 22,120 | (9) | | | | -0- | | | | | * | | Richard J. Mark | | | | 41,825 | (4) | | | | -0- | | | | | * | | Ronald A. Rittenmeyer | | | | 626,534 | (10) | | | | 119,260 | (11) | | | | * | | Tammy Romo | | | | 56,802 | (12) | | | | -0- | | | | | * | | Saumya Sutaria | | | | 100,331 | | | | | -0- | | | | | * | | Nadja Y. West | | | | 19,984 | (13) | | | | -0- | | | | | * | | Current executive officers and directors as a group (17 persons) | | | | 1,538,936 | (14) | | | | 188,368 | | | | | 1.6 | % |

| (3) | Represents 1,562 RSUs granted under our 2019 Stock Incentive Plan. | (4) | Includes 16,030 RSUs granted under our 2019 Stock Incentive Plan. |

| (5) | Represents 2,798 RSUs granted under our 2019 Stock Incentive Plan. |

| (6) | Includes 16,088 RSUs granted under our 2019 Stock Incentive Plan. |

| (7) | Includes 13,313 RSUs granted under our 2019 Stock Incentive Plan. |

| (8) | Includes 12,850 RSUs granted under our 2019 Stock Incentive Plan. |

| (9) | Includes 14,397 RSUs granted under our 2019 Stock Incentive Plan. |

| (10) | Includes 14,481 RSUs granted under our 2019 Stock Incentive Plan. |

| (11) | Represents 20,707 RSUs that vest in full upon Mr. Park’s relocation of his primary residence to the Dallas, Texas area, provided that such relocation is completed by September 1, 2025. |

| (12) | Includes 12,789 RSUs granted under our 2019 Stock Incentive Plan. |

| (13) | Represents 3,682 RSUs granted under our 2019 Stock Incentive Plan. |

| (14) | Includes 14,044 RSUs granted under our 2019 Stock Incentive Plan. |

| (15) | Does not include securities owned by Mr. Cancelmi, who retired effective December 31, 2023. |

| (16) | Includes RSUs granted to non-employee directors under our 2019 Stock Incentive Plan. |

(1) | | | | | | 40 | |

| | | Except as indicated, each individual named has sole control as to investment and voting power with respect to the securities owned.

Securities Ownership (2) | As noted below, the totals in this column for each non-employee director include RSUs granted under the terms of our stock incentive plans. These RSUs are settled in shares of our common stock either upon termination of service or upon the third anniversary of the date of grant.

|

(3) | Includes 33,947 RSUs granted under our stock incentive plans.

|

(4) | Includes 34,005 RSUs granted under our stock incentive plans.

|

(5) | Includes 29,868 RSUs granted under our stock incentive plans.

|

(6) | Represents 3,057 RSUs granted under our stock incentive plans.

|

(7) | Holdings for Ms. Karrmann are reported as of October 24, 2020, the date that she ceased to be an executive officer of the Company.

|

(8) | Includes 37,794 RSUs granted under our stock incentive plans.

|

(9) | Represents 22,120 RSUs granted under our stock incentive plans.

|

(10) | Includes 15,000 shares held by Mr. Rittenmeyer’s spouse.

|

(11) | Represents 119,260 RSUs granted under our stock incentive plans. These RSUs are scheduled to vest and settle in shares of our common stock on March 31, 2021.

|

(12) | Includes 30,706 RSUs granted under our stock incentive plans.

|

(13) | Includes 18,984 RSUs granted under our stock incentive plans.

|

(14) | Includes RSUs granted to non-employee directors under our stock incentive plans.

|

| | | | | | | 28 | |  | | | | |

Securities Ownership

Securities Ownership of Certain Shareholders Based on reports filed with the SEC, each of the following entities owns more than 5% of our outstanding common stock as of the dates indicated below. We know of no other entity or person that beneficially owns more than 5% of our outstanding common stock. | | | | | | | | | | | | | | Name and Address | | Number of Shares Beneficially Owned | | Percent of Class as of March 1, 2024 | The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 | | | | 11,110,396 | (1) | | | | 10.91 | % | BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | | | | 10,881,666 | (2) | | | | 10.69 | % | Glenview Capital Management, LLC 767 Fifth Avenue, 44th Floor New York, NY 10153 | | | | 7,742,322 | (3) | | | | 7.60 | % | T. Rowe Price Associates, Inc. 100 E. Pratt Street Baltimore, MD 21202 | | | | 7,124,316 | (4) | | | | 7.0 | % | Investco Ltd. 1555 Peachtree Street NE, Suite 1800 Atlanta, GA 30309 | | | | 5,422,099 | (5) | | | | 5.32 | % |

| (1) | Based on a Schedule 13G/A filed with the SEC eachon February 13, 2024 by The Vanguard Group, Inc., on behalf of the following entities owns more than 5% of our outstanding common stockitself and its named subsidiaries and affiliates (collectively, “Vanguard”), as of the dates indicated below. We know of no other entity or person that beneficially owns more than 5% of our outstanding common stock. | | | | | | | | | | | | | | Name and Address | | Number of Shares Beneficially Owned | | Percent of Class as of March 15, 2021 | Glenview Capital Management, LLC 767 Fifth Avenue, 44th Floor New York, NY 10153 | | | | 16,225,320 | (1) | | | | 15.24 | % | BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | | | | 12,191,094 | (2) | | | | 11.45 | % | The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 | | | | 11,407,086 | (3) | | | | 10.71 | % | Harris Associates L.P. 111 S. Wacker Drive, Suite 4600 Chicago IL 60606 | | | | 7,114,001 | (4) | | | | 6.68 | % |

(1) | Based on a Schedule 13D/A filed with the SEC on February 4, 2021 by Glenview Capital Management, LLC and its named subsidiaries and affiliates (collectively, “Glenview”), and Lawrence M. Robbins, as of February 2, 2021, and additional information available to the Company as described in this footnote. Glenview Capital Management, LLC serves as an investment manager to various Glenview funds, and Mr. Robbins is the Chief Executive Officer of Glenview Capital Management. Glenview and Mr. Robbins reported shared voting and investment power with respect to all of the shares indicated above.

|

(2) | Based on a Schedule 13G/A filed with the SEC on January 27, 2021 by BlackRock, Inc., on behalf of itself and its named subsidiaries and affiliates (collectively, “BlackRock”), as of December 31, 2020. BlackRock reported sole voting power with respect to 11,992,806December 29, 2023. Vanguard reported sole voting power with respect to 0 of the shares indicated above, shared voting power with respect to 38,659 of the shares indicated above, sole dispositive power with respect to 10,969,187 of the shares indicated above and shared dispositive power with respect to 141,209 of the shares indicated above.

|

| (2) | Based on a Schedule 13G/A filed with the SEC on February 2, 2024 by BlackRock, Inc., on behalf of itself and its named subsidiaries and affiliates (collectively, “BlackRock”), as of December 31, 2023. BlackRock reported sole voting power with respect to 10,528,387 of the shares indicated above and sole dispositive power with respect to all of the shares indicated above. |

| (3) | Based on a Schedule 13D/A filed with the SEC on February 14, 2024 by Glenview Capital Management, LLC and its named subsidiaries and affiliates (collectively, “Glenview”), and Lawrence M. Robbins, as of December 31, 2023, and additional information available to the Company as described in this footnote. Glenview Capital Management, LLC serves as an investment manager to various Glenview funds, and Mr. Robbins is the Chief Executive Officer of Glenview Capital Management. Glenview and Mr. Robbins reported shared voting and investment power with respect to all of the shares indicated above. |

| (4) | Based on a Schedule 13G filed with the SEC on February 14, 2024 by T. Rowe Price Associates, Inc. (T. Rowe Price), as of December 31, 2023. T. Rowe Price reported sole voting power with respect to 3,497,685 of the shares indicated above and sole dispositive power with respect to all of the shares indicated above. |

| (5) | Based on a Schedule 13G filed with the SEC on February 9, 2024 by Invesco Ltd. (Invesco), as of December 29, 2023. Invesco, together with certain of its subsidiaries and in its capacity as a parent holding company to its investment advisors, reported sole voting power with respect to 5,298,784 shares and sole dispositive power with respect to all of the shares indicated above. |

(3) | Based on a Schedule 13G/A filed with the SEC on February 10, 2021 by The Vanguard Group, Inc., on behalf of itself and its named subsidiaries and affiliates (collectively, “Vanguard”), as of December 31, 2020. Vanguard reported sole voting power with respect to 0 of the shares indicated above, shared voting power with respect to 116,030 of the shares indicated above, sole dispositive power with respect to 11,210,504 of the shares indicated above and shared dispositive power with respect to 196,582 of the shares indicated above.

(4) | Based on a Schedule 13G/A filed with the SEC on February 12, 2021 by Harris Associates L.P. (Harris), as of December 31, 2020. Harris reported sole voting power with respect to 4,710,340 shares and sole dispositive power with respect to all of the shares indicated above.

|

Delinquent Section 16(a) Reports

Due to a technical issue, the Form 4 filing reporting one transaction for J. Robert Kerrey was filed one day late.

Compensation Discussion & Analysis

This CD&A describes our compensation programs and reviews compensation decisions

Compensation Discussion & Analysis This Compensation Discussion and Analysis (CD&A) describes our executive compensation programs, our process for determining executive compensation and the compensation paid to the following NEOs for 2023: | | | | | Named Executive Officers (NEOs) for 2020:Officer | | Title | | | Saum Sutaria | Chairman and Chief Executive Officer | | | Dan Cancelmi | | Former Executive Vice President and Chief Financial Officer(1) | | | Tom Arnst | | Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary | | | Lisa Foo | | Executive Vice President, Commercial Operations | | | | | | | Named Executive Officer

| | Title | | | Ron Rittenmeyer

| | Executive Chairman and Chief Executive Officer (CEO)

| | | Saum Sutaria

| | President and Chief Operating Officer

| | | Dan Cancelmi

| | Executive Vice President and Chief Financial Officer

| | | Audrey Andrews

| | Executive Vice President and General Counsel

| | | Paola Arbour | | Executive Vice President and Chief Information Officer |

| (1) | Mr. Cancelmi retired as Executive Vice President and Chief Financial Officer effective December 31, 2023 and was succeeded by Sun Park effective January 1, 2024. | Sandi Karrmann

|

CD&A Table of Contents | | Former Executive Vice President and Chief Human Resources Officer(1)

| 2023: Advancing our Strategy and Mission to Expand Quality, Compassionate Care (1) | Ms. Karrmann served as Executive Vice President and Chief Human Resources Officer of the Company until her resignation on October 24, 2020

| | | 43 | |

| CD&A Table of Contents2023 Compensation Program Highlights

| | | 44 | | 2023 Say-on-Pay Vote | | | Detailed Description and Analysis | | | | | | | 30 | |  | | | | | | 47 | |

|

2023 Compensation Discussion & AnalysisDecisions Overview

2020: Delivering Quality, Compassionate Care While Responding to COVID-19

In 2020, Tenet faced challenges never experienced in our history. Our ability to perform under such difficult and constantly evolving circumstances underscored the strength of our colleagues across the enterprise as well as the positive impact of our multi-year turnaround, which began under the leadership of our Board and Executive Chairman and Chief Executive Officer (CEO), Ron Rittenmeyer. We implemented a comprehensive and active response to the pandemic, focused on the safety of our personnel and our patients, and steadily improved performance in each operating segment as we moved through the year. We continued to advance top-tier clinical programs to serve growing acute and chronic care needs in our hospitals, while completing a transformational ambulatory transaction and pivoting our business toward higher-growth, lower cost-of-care settings. And, we continued to post an improved level of margin performance at Conifer, which provided exceptional support to clients throughout the pandemic.

| | | | | | | | | COVID-19 Response

We continued to manage COVID-19 and its impact on operations, and we focused on the highest standards for quality and safety. Our protocols were designed to protect our patients and employees as we all battled the pandemic. Operational teams used real-time data to ensure sufficient staffing, intensive care unit bed capacity and personal protective equipment (PPE), all while adapting to constantly changing federal and state guidelines and managing ongoing surges across the country.

| | Operational Excellence

Our results in this last year underscore the operational discipline we have put into action on an ongoing basis. As the pandemic has continued to evolve in waves, we met each sharp turn with a carefully coordinated response. Our Incident Command Center has served as the hub of our pandemic response to provide continuity across the enterprise and ensure we always had dedicated resources in place to support caregivers and staff in our facilities.

| | Transformative Acquisition

In December 2020, we announced the acquisition of a portfolio of 45 ambulatory surgical centers from SurgCenter Development for approximately $1.1 billion. This transaction supports our ongoing commitment to invest in lower cost of care, consumer friendly facilities that improve healthcare affordability; cements Tenet’s position as the preeminent national musculoskeletal services leader across the care continuum; and enhances Tenet’s overall business mix and earnings profile.

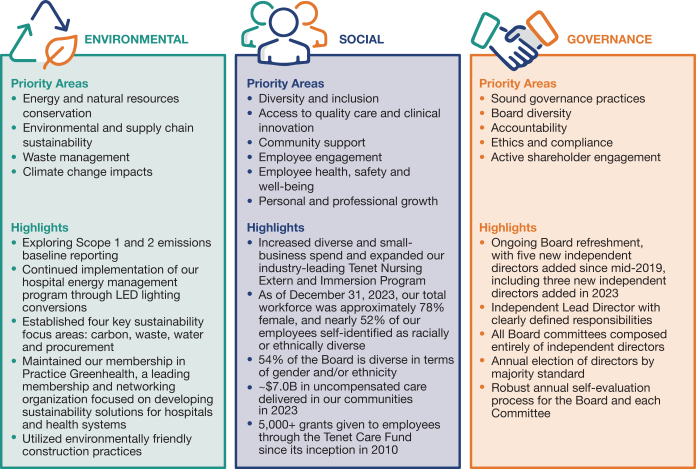

| | | | | | | | Commitment to ESG

In 2020, we accelerated our commitment to environmental, social and governance (ESG) goals. We supported our employees in need, strengthened our sustainability program, and launched additional diversity and inclusion programs. In 2021, our Board formed an ESG Committee that will further support these efforts going forward.

| | Improved Financial Position

We ensured there was proactive management of liquidity throughout the pandemic by issuing additional notes as well as expanding our revolver debt capacity. We actively and responsibly managed our capital budget across the entire system, and our consistent focus on free cash flow helped deliver excellent results.

| | Cultivating Talent

Our efforts to ensure strong leadership across the enterprise continued to be a top priority in 2020. We attracted external talent to provide outside perspectives and new thinking. We also elevated strong performers by expanding their scope and by transitioning internal leaders to new opportunities within the enterprise that will support their further growth and development.

|

| Base Salary | | | 47 | |

| | | 47 | | Long-Term Incentive Compensation | | | 50 | | The Compensation Discussion & AnalysisProcess | | | 52 | |

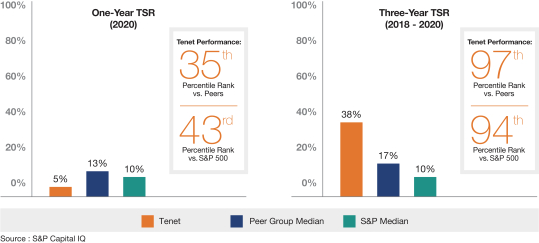

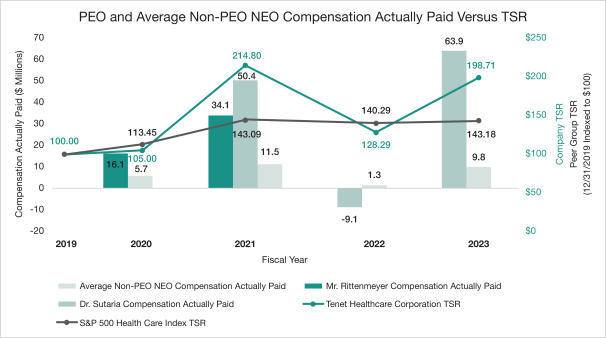

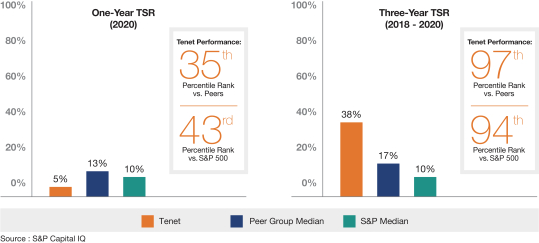

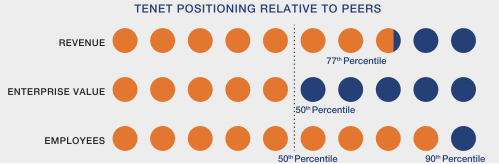

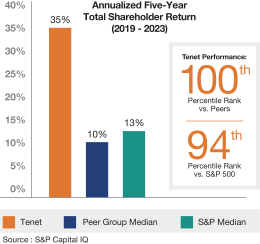

Our strong relative TSR performance highlights the successful execution of our multi-year turnaround strategy since our change in leadership a little over three years ago. We believe that our three-year TSR, which captures the effectRole of the intense turnaround effort that began in late 2017, is a more meaningful measure of our longer-term performance than our one-year TSR, which can be significantly impacted by short-term market volatility unrelated to our performance (as occurred at various times during 2020). Despite the challenge and uncertain macroeconomic environment presented during the last year by COVID-19, the achievements highlighted above illustrate the positive impact of our multi-year turnaround as well as our continued momentum in building a framework for our long-term growth and success. Further, our 2021 year-to-date TSR performance (as of March 25, 2021) remains strong and ranks above the 90th percentile of our peer group and the S&P 500.Human Resources Committee

2020 Compensation Program Highlights

| | | | | Secured Extension of CEO’s Employment

| | In February 2020, after considering his extraordinary accomplishments in turning Tenet around and his continued importance in implementing the Company’s long-term strategic goals, the Board extended Mr. Rittenmeyer’s term of service from June 2021 through December 2022 through an amendment to his Employment Agreement that:

• Increased Mr. Rittenmeyer’s annual base salary to $1.5 million

• Provided for an award of RSUs, vesting quarterly through December 2022, valued at $10 million to recognize his extended service period

| | | Streamlined

LTI Program

| | In February 2020, the HR Committee approved a streamlined and simplified long-term equity compensation program, which further aligns NEO and shareholder interests. The 2020 LTI compensation for executive officers other than Mr. Rittenmeyer and Dr. Sutaria consists entirely of RSUs:

• 50% time-based awards vesting ratably over three years

• 50% performance-based awards earned over a three-year period based on the achievement of Adjusted EPS and Adjusted Free Cash Flow Less Cash NCI. These performance metrics are established at the start of each year of the three-year performance period subject to a cumulative three-year Relative TSR performance modifier.*

| | | Donated Salaries in

Response to

COVID-19

| | Mr. Rittenmeyer donated 100% of his base salary earned from April through June 2020 to the Tenet Care Fund, a 501(c)(3) established to assist Company employees who have experienced hardships from the COVID-19 pandemic and other challenges. Each of our other NEOs donated 20% of their salaries over the same period. The Tenet Care Fund supported over 1,100 of our employees in 2020, with approximately $2,000,000 raised over the year. | | | 2020 Annual Incentive

Plan Payouts

| | Our Compensation Committee applied negative discretion after our 2020 annual incentives were earned at 200% of target, based upon our maximum achievement of both performance metrics, Adjusted EBITDA (weighted 70%) and Adjusted Free Cash Flow Less NCI (weighted 30%). As a result of these downward adjustments, corporate performance was deemed achieved at 117% of target and final payouts for our NEOs ranged from 130% to 150% of target payout levels after applying each officer’s individual performance multiplier.** |

* | See Appendix A for definitions of Adjusted EPS and Adjusted Free Cash Flow which is then less cash distributions paid to NCI as reflected on the Company’s consolidated statements of cash flow.

|

** | Ms. Karrmann did not receive a 2020 annual incentive plan payment due to her October 2020 resignation.

|

| | | | | | | 32 | |  | | | | |

Compensation Discussion & Analysis

Say-On-Pay Vote

Our annual Say-on-Pay vote is one of our opportunities to receive feedback from shareholders regarding our executive compensation program, and the HR Committee takes the result of this vote into account when shaping the compensation program for the Company’s NEOs. Our Company has continued to receive strong support for our Say-on-Pay proposal every year since 2017, with 90% of votes cast in favor of such proposal at our 2020 Annual Meeting. In light of the continued strong shareholder support, our HR Committee did not make any changes to the structure of our executive compensation program as a result of the 2020 vote. The HR Committee will continue to consider shareholder feedback, input from our independent compensation consultant and the outcomes of future Say-on-Pay votes when assessing our executive compensation programs and policies and making compensation decisions for our NEOs.

Compensation Elements Link Pay with Performance

The following table outlines the primary components of our NEOs’ 2020 compensation packages (other than Mr. Rittenmeyer and Dr. Sutaria, as discussed above):

| | | | | | | | Element | | Description | | Purpose | | | | Base Salary

| | • Fixed cash compensation set annually

• Based on market data, individual performance, internal pay equity and the scope and complexity of the role

| | • Attracts and retains talented executives with competitive fixed pay

| | | | Annual

Incentive Plan

| | • Compensation tied to achievement of annual performance goals

• Award amount increases with executive’s level of influence on business outcomes and reflects individual performance

| | • Motivates and rewards executives for meeting annual goals that drive long-term growth

• Challenging, objective performance metrics set annually based on Company’s business plans

| | Long-Term Incentive Compensation  | | | | Performance -

Based RSUs

| | • Awards cliff vest in three years based on performance against adjusted earnings per share (EPS)* and adjusted free cash flow (FCF) minus cash distributions paid to noncontrolling interests (NCI).* These goals are established at the beginning of each year within the three-year period

• Relative total shareholder return (TSR) modifier is measured over the full three-year performance period and may reduce or increase earned payouts

| | • Establishing goals for each year of the three-year performance period provides the Company with flexibility to ensure goals remain relevant and challenging throughout the performance period and avoids awards that weaken retentive value in the event of a single year of below threshold performance

• Relative TSR modifier applied over the full vesting period strengthens long-term shareholder alignment and motivates our executives to achieve long-term share price appreciation

| | | | Time-Based RSUs

| | • RSUs vest ratably over three years

| | • Aligns economic interests of executives and shareholders through equity ownership

• Encourages retention and subject to forfeiture in the event executive terminates employment

|

* | See Appendix A for definitions of Adjusted EPS and Adjusted Free Cash Flow which is then less cash distributions paid to NCI as reflected on the Company’s consolidated statements of cash flow.

|

|

Independent Compensation Discussion & Analysis ConsultantBest Practices Support Strong Compensation Governance We maintain the following best practices to ensure our governance of executive compensation reflects our pay-for-performance philosophy and aligns the interests of our executives and shareholders.

| | | | | | | | | | | 42 | |

| | |

Compensation Discussion & Analysis

Overview 2023: Advancing our Strategy and Mission to Expand Quality, Compassionate Care In 2023, Tenet delivered outstanding operating results driven by strong revenue growth and disciplined cost management. Our strong operational execution during 2023 demonstrates the commitment of our colleagues across the enterprise and our focus on providing quality, compassionate care to the communities we serve. Our Ambulatory Care segment grew through the expansion of service lines and our population of partnered and affiliated physicians, accretive acquisitions and de novo development. In addition, we continue to enhance high-acuity services at our hospitals, including cardiovascular, neurosciences, surgical services and trauma. | | | | | | | | | Operational Excellence Our results in 2023 demonstrate our focus on operational excellence. We advanced our high-acuity strategy in our hospital business, leveraging data and analytics to significantly reduce contract labor costs and effectively manage operating costs. We continue to achieve attractive margins across each of our businesses, driven by this operational efficiency. | | Financial Performance We delivered outstanding results across our portfolio in 2023. These results were driven by strong volume growth, pricing yield and disciplined operations that enabled us to manage operating costs in a challenging industry environment. Adjusted EBITDA margins remained strong due to our operational focus and effective execution. | | Expanded Ambulatory Care We added 30 ambulatory surgery centers to our portfolio through acquisitions and the opening of de novo facilities through a continued focus on business development. Many of these new centers specialize in higher-acuity services, including orthopedics, and represent attractive additions to our portfolio. | | | | | | | | Refinanced and Retired Debt During the year ended December 31, 2023, we retired approximately $1.345 billion aggregate principal amount of certain of our senior unsecured notes and senior secured first lien notes. These notes were retired using proceeds from the May 2023 sale of $1.35 billion aggregate principal amount of 6.750% senior secured first lien notes due 2031 and cash on hand. | | Workforce Development We delivered unprecedented reductions in contract labor spend allowing more of our own workforce to work directly with our patients. Our results were achieved by increasing our new graduate hiring pipeline through nursing school relationships, strengthening our internal clinical bench, and delivering facility level workforce targets. We introduced agile frontline staffing models to optimize utilization of skills from entry level to higher specialty competencies. We developed and executed a system-wide wholistic retention strategy that drove facility level accountability to execute leading practices, improve manager quality, and reduce turnover. | | Clinical Quality and Patient Safety We continue to execute our disciplined strategy to prevent life-threatening infections and injuries and deliver high-quality care to our patients. In 2023, we delivered notable improvements in the metrics we track for patient safety and quality care. Our commitment to quality is driving a strong patient experience and continued improvement. |

Compensation Discussion & Analysis

2023 Compensation Program Highlights | | | | | 34 | |  | | | | |

Compensation Discussion & Analysis

Detailed Description and Analysis2023 Annual Incentive

2020 Compensation DecisionsPlan Payouts

| | Base Salary

Base salary provides our NEOs with a fixed base annual income and helps us attract and retain high-performing executives. The HR Committee sets NEO salaries each year considering individual performance reviews, internal pay equity considerations, the scope and complexity of the executive’s role and an assessment of peer group and market survey data provided by our independent compensation consultant. In addition to the increase in Mr. Rittenmeyer’s base salary as part of his 2020 Employment Agreement extension described above, in February 2020,2024, the HR Committee approved a 4.9% increase in Mr. Cancelmi’s base salary in recognition of his strong performance and to better align with competitive market practices. The HR Committee determined that the base salaries for all other NEOs would remain unchanged for 2020.

As discussed above, to help Company employees facing adversity during the COVID-19 pandemic, Mr. Rittenmeyer donated 100% of his base salary earned from April through June 2020 to the Tenet Care Fund, and each of the other NEOs donated 20% of their salaries to the Tenet Care Fund over the same period.

| | | Named Executive Officer

| | 2020

Annual Base Salary

(As of December 31, 2020)

| | | Ron Rittenmeyer

| | $1,500,000

| | | Saum Sutaria

| | $1,000,000 | | | Dan Cancelmi

| | $ 650,000 | | | Audrey Andrews

| | $ 550,000 | | | Paola Arbour

| | $ 500,000 | | | Sandi Karrmann(1)

| | $ 500,000 |

| (1) | Ms. Karrmann served as Executive Vice President and Chief Human Resources Officer of the Company until her resignation on October 24, 2020.

|

Annual Incentive Plan

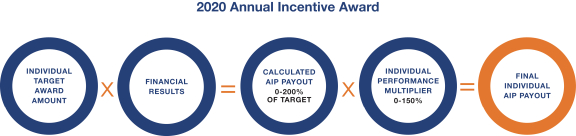

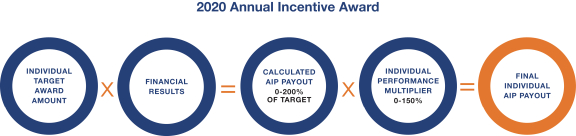

Our AIP provides annual cash incentives tofinal payouts under our executives that drive financial, operational and individual performance. The program is designed to motivate executives to meet objectives that matter to our investors and align with the Company’s long-term strategy. To that end, the HR Committee selects financial and operational metrics that our executives directly influence with challenging targets so that, in order to pay out, the Company must meet the goals communicated to shareholders. The2023 Annual Incentive Plan, also includes anwith corporate performance achieved at 200% of target. Final payouts for our NEOs ranged from 240% to 280% of target payout levels after application of each officer’s individual performance component to focus directly on the contributions of each NEO and to reflect performance on qualitative factors like leadership, integrity, promotion of Company values, and a positive influence on Company culture.multiplier.

| | | | | | | | | | 2023 LTI Program Awards | | 2021 PROXY STATEMENT | | | 35 | |

Compensation Discussion & Analysis

2020 Target Annual Incentive Award Levels for Named Executive Officers

In 2020,March 2023, the HR Committee approved the following target bonus award levels for each NEO, none of which were increased relative to the prior year. | | | | | Named Executive Officer

| | Target Award Relative

to Base Salary | | | | Ron Rittenmeyer

| | | 150

| %

| | | Saum Sutaria

| | | 100 | % | | | Dan Cancelmi

| | | 100 | % | | | Audrey Andrews

| | | 75 | % | | | Paola Arbour

| | | 75 | % | | | Sandi Karrmann

| | | 75 | % |

2020 AIP Performance Metrics and Results

Funding for the 2020 AIP pool was based on the Company’s total annual Adjusted EBITDA (weighted 70%) and Adjusted Free Cash Flow Less Cash Payments to Noncontrolling Interests (Adjusted Free Cash Flow Less NCI) (weighted 30%). Payout of these metrics can range from 0% to 200% depending on performance.

The HR Committee continued to use Adjusted EBITDA as the most significant metric because it is the primary measure used by financial analysts and investors to judge the Company’s financial performance. The HR Committee selected Adjusted Free Cash Flow less NCI as a metric because it captures the Company’s ability to sustainably generate cash that can be used for the Company’s long-term strategic goals, including acquisitions, investing in joint ventures, or repurchasing outstanding equity or debt securities, as well as other general corporate purposes. Furthermore, free cash flow generation allows the Company to fund growth without raising additional debt and can also be used to retire existing indebtedness, both of which enhance long-term shareholder value. Given the importance of Adjusted Free Cash Flow less NCI to both short-term and long-term value creation for shareholders, the HR Committee decided to continue using it in both the 2020 AIP and LTI programs.

The HR Committee, on the recommendation of management, determined that it was appropriate to exercise negative discretion to reduce the AIP funding pool from 200% to 117% in order to offset favorability in our overall financial performance resulting from the COVID-19 pandemic, including grants and other benefits the Company received under the CARES Act, that was unrelated to management’s actions. The adjusted payout level reflects the Company’s projected performance before the impact of the COVID-19 pandemic.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Metric | | Threshold

Level | | Target

Level | | Maximum

Level | | Actual

Performance | | Percentage

of Target | | Calculated

Payout | | | | | | | | Adjusted EBITDA(1) | | | $ | 2.650 billion | | | | $ | 2.825 billion | | | | $ | 3.050 billion | | | | $ | 3.146 billion | | | | | 200 | % | | 140 | | | | | | | | | Adjusted FCF less NCI(2) | | | $ | 390 million | | | | $ | 480 million | | | | $ | 570 million | | | | $ | 2,914 million | | | | | 200 | % | | 60 | | | | Initial Funding Pool | | | 200% | | | Negative Discretionary Adjustment | | | (83%) | | | Final Funding Pool | | | 117% of Target |

(1) | See Appendix A for definition of Adjusted EBITDA.

|

(2) | Adjusted Free Cash Flow (see Appendix A for definition) minus cash distributions paid to NCI reflected on the Company’s consolidated statements of cash flow.

|

Individual Performance Modifiers

After completion of the fiscal year, the HR Committee undertakes a robust individual performance review for our executive officers. These reviews allow the HR Committee to incorporate into the AIP program certain quantitative and qualitative elements tailored specifically to each executive’s role and circumstances. These reviews also allow the HR Committee to take into consideration factors such as integrity, promotion of Company values, and a positive influence on Company culture, which

| | | | | | | 36 | |  | | | | |

Compensation Discussion & Analysis

further the Company’s business objectives and strategies. The result is an individual performance multiplier applied to the calculated AIP amount that can range from 0% to 150%. The ratings are calibrated across the entire Company to ensure the AIP funding pool remains fixed.

For the CEO, the HR Committee gathers feedback from select members of management as well as a CEO self-evaluation and discusses the performance of the CEO with the other independent members of the Board in executive session. For reviews of other executive officers, the CEO provides the HR Committee a detailed evaluation and recommendation based in part on a self-assessment completed by each executive officer.

Compensation Discussion & Analysis

The HR Committee applied the following performance modifiers for our NEOs based on the material factors provided below. Ms. Karrmann did not receive a 2020 AIP Payout in light of her October 2020 resignation.

| | | | | | | | Named Executive Officer

| | Individual

Performance

Multiplier

| | Performance Review Summary | | | | Mr. Rittenmeyer

| | 150%

| | • Focused first and foremost on quality and safety, led a cohesive and coordinated enterprise-wide response to the pandemic while delivering strong financial and operational results in a turbulent year.

• Repositioned the Company’s growth trajectory by advancing key strategic objectives like the transformative acquisition of 45 ambulatory surgery centers.

• Strengthened the Company’s commitment to elevating its people, fostering an inclusive culture, ensuring effective governance and realigning on purpose.

| | | | Dr. Sutaria

| | 150%

| | • Leadership has been especially pivotal in accelerating our growth and performance, reassuring our ongoing resilience during the pandemic, and bringing to bear expanded offerings for patients notwithstanding the tremendous challenges we all faced in 2020.

• Continued to drive changes in business unit leadership to strengthen organizational roots and position our best people to expand their skills and continue to positively impact the enterprise.

• Appointed to the Company’s Board of Directors in November 2020.

| | | | Mr. Cancelmi

| | 140%

| | • Instrumental in leading our finance team through the pandemic with equal commitment to diligent review of various governmental orders and grants and improved quality of our ongoing operational processes.

• Restructured the balance sheet and reinforced investor confidence while ensuring transparency.

• Championed talent upgrades for key leadership roles in finance team.

| | | | Ms. Andrews

| | 130%

| | • Successfully navigated the pandemic related rules that changed frequently and covered all legal issues.

• Leadership and support to the compliance team that allowed us to meet key priorities notwithstanding the impact of COVID-19.

• Significant contributions to streamlining USPI’s structure and legal processes to align with enterprise goals.

| | | | Ms. Arbour

| | 130%

| | • Quickly led transition to successfully relocate our headquarters, satellite offices and Global Business Center (GBC) employees to a remote working environment within a short period.

• Improved process and successfully worked with third parties to meet cybersecurity protection goals.

• Adjusted capital expenditures while partnering with teams in the field on the right enterprise priorities and creating a true service culture.

|

| | | | | | | 38 | |  | | | | |

Compensation Discussion & Analysis

The table below shows target and actual AIP awards earned by each NEO for 2020.

| | | | | | | | | | | | | | | | | | | | | Named Executive Officer | | Target AIP Payout | | Calculated

AIP Payout | | Individual Performance Multiplier | | 2020 Actual AIP Payout | | | | | | Ron Rittenmeyer | | | $ | 2,250,000 | | | | $ | 2,632,500 | | | | | 150 | % | | | $ | 3,948,750 | | | | | | | Saum Sutaria | | | $ | 1,000,000 | | | | $ | 1,170,000 | | | | | 150 | % | | | $ | 1,755,000 | | | | | | | Dan Cancelmi | | | $ | 650,000 | | | | $ | 760,500 | | | | | 140 | % | | | $ | 1,064,700 | | | | | | | Audrey Andrews | | | $ | 412,500 | | | | $ | 482,625 | | | | | 130 | % | | | $ | 627,413 | | | | | | | Paola Arbour | | | $ | 375,000 | | | | $ | 438,750 | | | | | 130 | % | | | $ | 570,375 | | | | | | | Sandi Karrmann(1) | | | $ | 375,000 | | | | | N/A | | | | | N/A | | | | | N/A | | | | |

(1) | As a result of her separation, Ms. Karrmann was not eligible to receive an AIP payout.

|

Pandemic Special Bonuses

The HR Committee periodically approves additional “off-cycle” awards to key employees, including NEOs, in connection with promotions, recruitment and retention efforts, succession planning, or significant accomplishments or achievements. The Committee approved one-time cash bonuses of $500,000 and $250,000 to Dr. Sutaria and Mr. Cancelmi, respectively, to reward them for their special efforts during the pandemic in 2020. In particular, the Committee recognized Dr. Sutaria’s extraordinary achievements partnering with our hospitals and other providers to respond quickly and effectively to COVID-19 and Mr. Cancelmi’s success in maintaining the Company’s financial performance and liquidity during the most challenging periods of the year.

2023 Long-Term Incentive Compensation The HR Committee undertook a holistic review of our executive compensation program design in 2020 and determined that changes to the LTI design were appropriate to further encourage sustained value creation for shareholders and simplify our equity compensation structure. The LTI design changes primarily addressed the compensation of executive officers other than Mr. Rittenmeyer, whose LTI compensation is described above under “2020 Compensation Program Highlights”, and Dr. Sutaria, who entered into an employment agreement with the Company when he joined in 2019 that provides for an annual grant of $4,000,000 of time-based RSUs vesting ratably over three years. In 2020, the Committee awarded Dr. Sutaria performance-based RSUs valued at $1,000,000 in acknowledgement of his critical role in the Company’s future success and to further align his long-term incentives with those of the Company’s shareholders.

Beginning in 2020, LTI compensation(LTI) awards for executive officers other(other than Mr. Rittenmeyer and Dr. Sutaria moved to entirely in RSUs,Cancelmi*) comprised of the following RSUs:

• 50% time-based awards vesting ratably over three years, and • 50% performance-based awards earned over a three-year period. The HR Committee believes that a simplified equity-only program provides stronger alignmentperiod based on the achievement of management’s incentives with shareholder interests. In its review,Adjusted EPS** and Adjusted Free Cash Flow** minus cash distributions paid to noncontrolling interests (“NCI”) (Adjusted FCF Less NCI). These performance metrics are established at the HR Committee considered peer group and other market data, emerging best practices, the availabilitystart of shares under Company plans and the retention value of LTI compensation.

Compensation Discussion & Analysis

Long-Term Incentive Compensation

| | | | | | | | | | | | | | | | | Year 1 | | Year 2 | | Year 3 | | | | | Performance-Based RSUs

(50%) | | • Based on Adjusted FCF less Cash NCI and Adjusted EPS, with goals set annually on current conditions and business strategy to a tranche of three overlapping cycles with threshold (0%), target (100%), and max (200%) • Subject to Relative TSR modifier based on performance over the entire performance period (+/- 25% based on cumulative performance versus direct peers) | | Three-year performance period with one-year goals set annually | | | 33.3% | | 33.3% | | 33.3% | | | | | Time-Based RSUs

(50%) | | • Restricted stock unit that is solely subject to service-based vesting or forfeiture conditions • Awards directly align executive and shareholder interests while encouraging retention throughout the vesting cycle | | Vest ratably over three years | | | 33.3% | | 33.3% | | 33.3% |

| | | | | Performance Metrics

| | Description | | | Adjusted Earnings Per Share

| | • Key metric for our shareholders because our Adjusted Earnings drives share price performance

• Measures the Company’s per-share profitability, excluding certain gains and losses

| | | Adjusted Free Cash Flow Less NCI

| | • Sustained cash flow generation allows the Company to fund objectives important to the Company’s long-term strategy without raising additional debt

• Measures the Company’s ability to generate cash flows from operations that can be used for acquisitions, capital expenditures or repaying debt

| | | Relative Total Shareholder Return

| | • Comparing the Company’s share price performance to its direct competitors rewards management’s ability to deliver above-market returns to long-term shareholders

• Measures the Company’s shareholder return against its three direct publicly traded competitors: Community Health Systems, HCA Healthcare and Universal Health Services

• Three-year total shareholder return multiplier applied to full three-year performance period measured relative to three direct competitors, with +25% for ranking first, no change for second or third, and -25% for fourth

|

Rigor of Performance Goals

In establishing target, threshold and maximum performance levels for our performance-based cash awards, the HR Committee considers annual and longer-term growth rates that the Company discloses to shareholders, as well as the consensus of analyst estimates and business-planning projections. The HR Committee sets the target amounts at demanding levels that require NEOs to achieve significant improvement each year of the three-year performance period and beginningsubject to a cumulative three-year relative total shareholder return (“Relative TSR”) performance modifier.

| | | 2021 Performance Based RSUs | | In February 2024, the HR Committee certified final achievement of the 2021 performance-based RSUs granted to the NEOs, with such awards earned at 199.7% of target as a result of exceeding the 2020 awards,maximum target for each applicable performance goal for 2021, exceeding the target Adjusted EPS goal for 2022, below threshold achievement for the Adjusted FCF Less NCI goal for 2022, exceeding the maximum target for each applicable performance goal for 2023 and cumulative Relative TSR ranking first against three direct competitors, resulting in application of the +25% modifier. |

| * | In light of Mr. Cancelmi’s announced retirement, in March 2023, he received a 100% time-based award that vested on December 31, 2023. |

| ** | See Appendix A for definitions of Adjusted EPS and Adjusted Free Cash Flow; cash distributions paid to NCI are as reflected on the Company’s consolidated statements of cash flows. |

2023 Say-on-Pay Vote Our annual Say-on-Pay vote is one of our opportunities to receive feedback from shareholders regarding our executive compensation program, and the HR Committee takes the result of this vote into account when shaping the compensation program for the Company’s NEOs. At our 2023 Annual Meeting, the Say-on-Pay proposal received over 94% approval, demonstrating ongoing strong support for our executive compensation program. In light of this continued shareholder support, our HR Committee did not make any changes to the structure of our executive compensation program as a result of the 2023 vote. | | | | | | 44 | |

| | |

Compensation Discussion & Analysis

Compensation Elements Link Pay with Performance The following table outlines the primary components of our NEOs’ 2023 compensation packages: | | | | | | Element | | Description | | Purpose | | | | Base Salary | | • Fixed cash compensation set annually • Based on market data, individual performance, internal pay equity, and the scope and complexity of the officer’s role | | • Attracts and retains talented executives with competitive fixed pay | | | | Annual Incentive Plan | | • Compensation tied to achievement of annual performance goals • Target award amounts increase with executive’s level of influence on business outcomes and reflect individual performance and internal equity | | • Motivates and rewards executives for meeting or exceeding annual goals that drive long-term growth • Challenging, objective performance metrics set annually based on the Company’s business plans | | | Long-Term Incentive Compensation | | | | Performance-

Based RSUs

| | • Performance-based RSUs cliff vest after a three-year performance period based one-half on Adjusted EPS* and one-half on Adjusted FCF Less NCI*; these goals are established at the beginning of each one-yearyear within the three-year performance period • Relative TSR multiplier is measured over the full three-year performance period and may reduce or increase earned payouts by 25% | | • Establishing goals for each year of the three-year performance period provides the Company with flexibility to ensure that the goals remain relevant and challenging asthroughout the overall three-year performance period progresses. Forand avoids awards that have weakened retentive value in the event of a single year of below-threshold performance or windfall value in the event of a single year of superior performance • Applying the Relative TSR modifier,multiplier over the Company placing first among the direct peer group results in a 25% increase,full performance period strengthens long-term shareholder alignment and the Company placing fourth among the direct peer group results in a 25% decrease, with no adjustments for placing second or third among the direct peer group.motivates our executives to achieve long-term share price appreciation | | | | Time-Based RSUs | | | | | | | 40 | |  | | | | |

Compensation Discussion & Analysis

| | | | | | | | | | | | | | | | | | | • Time-based RSUs vest ratably over three years based on continued service** | | • Aligns economic interests of executives and shareholders through equity ownership • Provides strong retentive value |

| * | 2020 LTI Grant ValuesSee Appendix A for Named Executive Officers

The following table summarizesdefinitions of Adjusted EPS and Adjusted Free Cash Flow; cash distributions paid to NCI are as reflected on the total target grant valueCompany’s consolidated statements of LTI awards granted in February 2020 to eachcash flows.

|

| ** | In light of our NEOs participating in our 2020 LTI program. LTI Compensation forhis announced retirement, Mr. Rittenmeyer is described above under “2020 Compensation Program Highlights.” | | | | | | | | | | | | | | | | | Named Executive Officer | | Performance-

Based RSUs(1)(2) | | | Time-Based RSUS(2) | | | Total 2020 LTI

Grant Value | | | | | | Saum Sutaria | | $ | 1,000,022 | | | $ | 4,000,003 | | | $ | 5,000,025 | | | | | | Dan Cancelmi | | $ | 1,250,027 | | | $ | 1,250,027 | | | $ | 2,500,054 | | | | | | Audrey Andrews | | $ | 750,016 | | | $ | 750,016 | | | $ | 1,500,032 | | | | | | Paola Arbour | | $ | 450,026 | | | $ | 450,026 | | | $ | 900,052 | | | | | | Sandi Karrmann(3) | | $ | 487,501 | | | $ | 487,501 | | | $ | 975,002 | |

(1) | Assumes target level performance.Cancelmi’s time-based RSUs vested on December 31, 2023.

|

(2) | Value is based on the NYSE closing price per share of our common stock on the date of grant (February 26, 2020: $27.80).

Compensation Discussion & Analysis

Best Practices Support Strong Compensation Governance We maintain the following best practices to ensure our governance of executive compensation reflects our pay-for-performance philosophy and aligns the interests of our executives and shareholders. (3) | Ms. Karrmann forfeited her 2020 LTI awards upon her resignation.

| | | | | | 46 | |

| | |

Compensation Discussion & Analysis

Detailed Description and Analysis 2023 Compensation Decisions Base Salary Base salary provides our NEOs with a fixed base annual income and helps us attract and retain high-performing executives. The HR Committee sets base salaries for the NEOs each year considering individual performance reviews, internal pay equity considerations, the scope and complexity of the executive’s role, and an assessment of peer group and market survey data provided by our independent compensation consultant. In consideration of the data provided by our independent compensation consultant, no changes were made to base salaries for our NEOs in 2023. | | | | | Named Executive Officer | | Annual Base Salary (as of December 31, 2023) |

| | The Company will disclose its achievement againstSaum Sutaria

| | $1,500,000 | | | Dan Cancelmi | | $ 750,000 | | | Tom Arnst | | $ 650,000 | | | Lisa Foo | | $ 650,000 | | | Paola Arbour | | $ 550,000 | |

Annual Incentive Plan Our Annual Incentive Plan (AIP) provides annual cash incentives to our executives that drive financial, operational and individual performance. The program is designed to motivate executives to meet objectives that matter to our investors and align with the Company’s long-term strategy. To that end, the HR Committee selects financial and operational metrics that our executives directly influence with challenging targets so that, in order to pay out, the Company must meet the goals communicated to shareholders. The AIP also includes (i) an individual performance component to focus directly on the contributions of each NEO and to reflect performance on qualitative factors like leadership, integrity, promotion of Company values, and positively influencing Company culture, and (ii) a quality and compliance multiplier that promotes a culture of quality and compliance by rewarding or penalizing executives for clinical events, adherence to policies and procedures, and audit results. Final individual payouts under the AIP are determined as follows:

Compensation Discussion & Analysis

2023 Target Annual Incentive Award Levels for Named Executive Officers In 2023, the HR Committee approved the following target bonus award levels for each NEO. In consideration of the data provided by our independent compensation consultant, no changes were made to target bonuses for the 2023 AIP. | | | | | | | | Named Executive Officer | | Target Award Relative

to Base Salary | | | Saum Sutaria | | | | 150 | % | | | Dan Cancelmi | | | | 100 | % | | | Tom Arnst | | | | 75 | % | | | Lisa Foo | | | | 75 | % | | | Paola Arbour | | | | 75 | % |

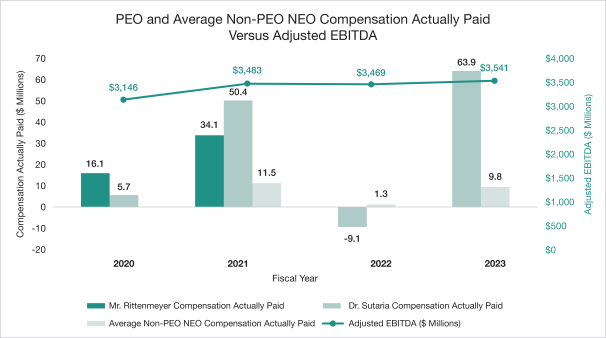

2023 AIP Performance Metrics and Results Funding for the 2023 AIP pool was based on the Company’s total annual Adjusted EBITDA (weighted 70%) and Adjusted FCF Less NCI (weighted 30%). Payout of each of these metrics could range from 0% to 200% depending on performance. The HR Committee continued to use Adjusted EBITDA as the most significant metric because it remains the primary measure used by financial analysts and investors to judge the Company’s financial performance. The HR Committee also continued to use Adjusted FCF Less NCI as a metric because it captures the Company’s ability to sustainably generate cash that can be used for the Company’s long-term strategic goals, including acquisitions, investing in joint ventures, or repurchasing outstanding equity or debt securities, as well as other general corporate purposes. Furthermore, free cash flow generation allows the Company to fund growth without raising additional debt and can also be used to retire existing indebtedness, both of which enhance long-term shareholder value. Given the importance of Adjusted FCF Less NCI to both short-term and long-term value creation for shareholders, the HR Committee decided to continue using it in both the 2023 AIP and LTI programs. When establishing the corporate performance metrics, the HR Committee is focused on establishing metrics that are challenging, but achievable, and in line with the Company’s public outlook guidance. As such, the Adjusted EBITDA target was set just slightly below 2022 Adjusted EBITDA, while the Adjusted FCF Less NCI target requires significant year-over-year improvement compared to 2022 Adjusted FCF Less NCI. The Adjusted EBITDA and Adjusted FCF Less NCI threshold, target and maximum levels and actual performance, as well as the final funding pool, are set forth below: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Metric | | Threshold

Level | | | Target Level | | | Maximum

Level | | | Actual

Performance | | | Percentage

of Target | | | Weighted Payout | | | | | | | | Adjusted EBITDA(1) | | $ | 3.160 billion | | | $ | 3.260 billion | | | $ | 3.360 billion | | | $ | 3.541 billion | | | | 200 | % | | 140% | | | | | | | | Adjusted FCF Less NCI(2) | | $ | 660 million | | | $ | 740 million | | | $ | 820 million | | | $ | 1.185 billion | | | | 200 | % | | 60% | | | Final Funding Pool | | | 200% of Target |

| (1) | See Appendix A for definition of Adjusted EBITDA. |

| (2) | Adjusted Free Cash Flow (see Appendix A for definition) minus cash distributions paid to NCI as reflected on the applicableCompany’s consolidated statements of cash flows and actual performance metrics forreflects adjustments made at the 2020 Performance-Based RSUs following completiondiscretion of the three-year performance period.HR Committee after considering certain items that impacted cash flows in 2023. |

Individual Performance Modifiers After completion of the fiscal year, the HR Committee undertakes a robust individual performance review for our executive officers. These reviews allow the HR Committee to incorporate into the AIP program certain quantitative and qualitative elements tailored specifically to each executive’s role and circumstances. These reviews also allow the HR Committee to take into consideration factors such as integrity, promotion of Company values, and a positive influence on Company culture, which further the Company’s business objectives and strategies. The result is an individual performance multiplier applied to the calculated AIP amount that can range from 0% to 150%. The ratings are calibrated across the entire Company to ensure the AIP funding pool remains fixed. | | | | | | 48 | |

| | |

Compensation Discussion & Analysis

For the Chairman and CEO, the HR Committee gathers feedback from select members of management and discusses the performance of the officer with the other independent members of the Board in executive session. For reviews of other executive officers, the Chairman and CEO provides the HR Committee a detailed evaluation and recommendation based in part on a self-assessment completed by each executive officer. The HR Committee applied the following performance modifiers for our NEOs based on the material factors provided below. | | | | | | | | | | | | Named Executive Officer | | Individual

Performance

Multiplier | | | Performance Review Summary | | | | | Results of 2018 LTI Awards

| | The performance cash LTI awards granted in March 2018 had a performance period of three years with performance measured across three equally weighted performance metricsDr. Sutaria

| |

| 140% |

| | • Drove key strategic and operating goals as set forth in the table below (achievement at target on any metric would result in 33.3% of the total payout). Two of our 2020 NEOs — Ms. Andrews and Mr. Cancelmi — received these grants, which vested in February 2021 following the HR Committee’s certificationpart of the Company’s achievement under thecontinuing transformative growth strategy • Led strong financial and operating performance metrics. Although Ms. Karrmann was granted a 2018 performance cash LTI award, it was forfeited on her October 2020 departure.through sustained data-driven, disciplined management and strong operational execution When considering

• Continued to strengthen the Company’s leadership team, as well as its ongoing commitment to diversity and an inclusive culture, to drive a high-performance culture committed to quality, safety and compliance | | | | |

| | Mr. Cancelmi | |

| 140% |

| | • Drove enhanced liquidity and capital structure by the retiring or refinancing of a significant amount of debt, which eliminated any noteworthy debt maturities for the Company until 2027 • Provided leadership in driving the achievement of the Company exceeding its 2023 Adjusted EBITDA and Adjusted Free Cash Flow budget targets; 2023 operating results exceeded our external guidance each quarter, which resulted in us raising our full year earnings and cash flow guidance each quarter • Facilitated the onboarding and smooth transition of responsibilities to our new Chief Financial Officer in advance of his retirement at the end of 2023 | | | | |

| | Mr. Arnst | |

| 130% |

| | • Led the continued strengthening of our legal and human resources teams to optimize performance and results • Drove the ongoing streamlining of our legal and human resources functions as part of our continuing enterprise service delivery model and external spend cost management • Championed the continuing shift of service functions to the GBC with over 3,500 roles successfully transitioned as of the end of 2023, as well as positioning the GBC for continued success | | | | |

| | Ms. Foo | |

| 130% |

| | • Enhanced strategy and business development capabilities across the Company, including market-based initiatives to support high acuity growth across acute care and ambulatory surgery services • Provided leadership in strategic capital deployment, physician engagement and capacity management to support continued volume recovery and sustained acuity improvement across the hospital portfolio • Furthered enterprise initiatives across procurement in support of the Company’s efficiency agenda as well as in data & analytics in support of the Company’s data-driven operating model | | | | |

| | Ms. Arbour | |

| 120% |

| | • Successfully executed against multi-year playbook of standardization to our enterprise Electronic Medical Record and Patient Management system for the Company’s acute care hospitals, while simultaneously migrating acute and corporate technology portfolio services to a new outsourced managed services provider • Led a transformative cyber security program, and executed year-over-year productivity improvements through a consolidated and scalable organization with a business case operating model governing technology investments and vendor management across the enterprise • Drove measurable performance gains with continued delivery of core clinical and infrastructure enhancements through software and cloud-based technology, reducing risks and enabling efficiency |

Compensation Discussion & Analysis

Quality and Compliance Modifier In addition, following the completion of the fiscal year the HR Committee reviews (i) negative hospital events that occurred during the fiscal year, such as any patterns of serious safety events and multiple condition level deficiencies during surveys, noncompliance resulting in immediate jeopardy, “needs improvement” or “unsatisfactory” audit ratings, and (ii) positive compliance and quality events, such as optimal internal audit results, optimal clinical compliance scorecard audit results and Centers for Medicare & Medicaid Services zero citation surveys. Following its review of 2023 quality and compliance performance, the HR Committee determined that no modification (positive or negative) would apply to the AIP awards for 2023 for the NEOs. 2023 AIP Payouts The table below shows target and actual AIP awards earned by each NEO for 2023. | | | | | | | | | | | | | | | | | | | | | | | | | | | Named Executive Officer | | Target

AIP Payout | | | Calculated AIP Payout | | | Individual

Performance

Multiplier | | | Compliance

Modifier | | | 2023 Actual

AIP Payout | | | | | | | | Saum Sutaria | | $ | 2,250,000 | | | $ | 4,500,000 | | | | 140 | % | | | 0 | % | | $ | 6,300,000 | | | | | | | | Dan Cancelmi | | $ | 750,000 | | | $ | 1,500,000 | | | | 140 | % | | | 0 | % | | $ | 2,100,000 | | | | | | | | Tom Arnst | | $ | 487,500 | | | $ | 975,000 | | | | 130 | % | | | 0 | % | | $ | 1,267,500 | | | | | | | | Lisa Foo | | $ | 487,500 | | | $ | 975,000 | | | | 130 | % | | | 0 | % | | $ | 1,267,500 | | | | | | | | Paola Arbour | | $ | 412,500 | | | $ | 825,000 | | | | 120 | % | | | 0 | % | | $ | 990,000 | |

Long-Term Incentive Compensation 2023 LTI Awards In 2023, LTI compensation for executive officers (other than Mr. Cancelmi) was granted entirely in RSUs, comprised of 50% time-based awards vesting ratably over three years and 50% performance-based awards earned over a three-year performance period. In light of his announced retirement, Mr. Cancelmi received a grant of time-based RSUs that vested in full on December 31, 2023. The HR Committee believes that the Company’s long-term incentive compensation program provides alignment of management’s incentives with shareholder interests and encourages sustained value creation for shareholders. | | | Performance-Based RSUs (50%) | | • Earned based on Adjusted FCF Less NCI and Adjusted EPS, with goals set annually to reflect current conditions and business strategy with below threshold (0%), threshold (50%), target (100%), and max (200%) • Subject to Relative TSR multiplier based on performance over the entire performance period (+/- 25% based on cumulative performance versus direct peers) | Time-Based RSUs (50%) | | • Solely subject to service-based vesting and forfeiture conditions • Awards directly align executive and shareholder interests while encouraging retention throughout the three-year ratable vesting cycle |

| | | | | | 50 | |

| | |

Compensation Discussion & Analysis

| | | | | Performance Metrics | | Rationale and Description | | | Adjusted Earnings Per Share | | • Key metric for our shareholders because our Adjusted EPS drives share price performance • Measures the Company’s per share profitability, excluding certain gains and losses | | | Adjusted Free Cash Flow Less Cash NCI (Adjusted Free Cash Flow) | | • Sustained cash flow generation allows the Company to fund objectives important to the Company’s long-term strategy without raising additional debt • Measures the Company’s ability to generate cash flows from operations that can be used for acquisitions, capital expenditures or repaying debt | | | Relative Total Shareholder

Return | | • Comparing the Company’s share price performance overto peer companies rewards management’s ability to deliver above-market returns to long-term shareholders • Measures the Company’s shareholder return against its three direct publicly traded hospital company peers: Community Health Systems, HCA Healthcare and Universal Health Services • Three-year Relative TSR multiplier applied to full three-year performance period and measured relative to the HR Committee, onthree hospital company peers named above, with the recommendationpayout percentage earned for financial performance multiplied by 125% for ranking first, no change for second or third, and 75% for fourth (subject to an overall maximum payout percentage of management, excluded certain federal payments and tax deferrals that the Company received under the CARES Act. Specifically, the HR Committee excluded Medicare advance payments that the Company expects to be required to repay in addition to payroll tax deferrals225% of target for fiscal year 2020. The negative discretion reduced the Company’s Adjusted Free Cash Flow to $2.012 billion, resulting in a below-target payout of 10.732023). |

2023 LTI Grant Values for Named Executive Officers The following table summarizes the total target grant value of LTI awards granted in March 2023 to each of our NEOs. In determining target grant values for the 2023 LTI awards, the HR Committee determined to increase Dr. Sutaria’s target by approximately $3 million and Ms. Foo’s target by approximately $500,000 in an effort to bring target LTI opportunities between the 50th and 75th percentile of the peer group. | | | | | | | | | | | | | | | | | | | | Named Executive Officer | | Performance-

Based RSUs(1)(2) | | Time-Based

RSUs(2) | | Total 2023 LTI Grant Value | | | | | Saum Sutaria | | | $ | 6,500,002 | | | | $ | 6,500,002 | | | | $ | 13,000,004 | | | | | | Dan Cancelmi | | | | -0- | | | | $ | 2,000,046 | | | | $ | 2,000,046 | | | | | | Tom Arnst | | | $ | 1,000,023 | | | | $ | 1,000,023 | | | | $ | 2,000,046 | | | | | | Lisa Foo | | | $ | 750,032 | | | | $ | 750,032 | | | | $ | 1,500,064 | | | | | | Paola Arbour | | | $ | 500,041 | | | | $ | 500,041 | | | | $ | 1,000,082 | |

| (1) | Assumes target level performance for the metric. Including such funds would have resulted in Adjusted Free Cash Flowfull performance-based RSU grant, which includes portions of $3.679 billion, well above the maximum payout. The following table shows the Company’s results under eachaward for which there is not a grant date fair value for purposes of Accounting Standards Codification (ASC) Topic 718 as the applicable performance metrics measured overconditions had not yet been established at the three-year period ended December 31, 2020.time of grant.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | 2018 LTI Performance Metric | | Threshold | | | Target | | | Maximum | | | Actual Performance | | | Calculated Payout | | | | | | | | Adjusted Earnings per Share | | $ | 6.82 | | | $ | 8.02 | | | $ | 9.22 | | | $ | 12.55 | | | | 66.67 | | | | | | | | Adjusted Free Cash Flow less NCI | | $ | 1.978 billion | | | $ | 2.327 billion | | | $ | 2.676 billion | | | $ | 2.012 billion | | | | 10.73 | | | | | | | | Relative total shareholder return | | | 4 | th | | | 3 | rd | | | 1 | st | | | 1 | st | | | 66.67 | | | | Total Pay Delivery | | | | 144.06% of Target | |

| (2) | Additional Awards for Ms. Karrmann

In February 2020, Ms. Karrmann executed a cash bonus agreement pursuant to which she received $944,045 in connection withValue is based on the terminationNYSE closing price per share ($59.55) of our common stock on the USPI Holding Company, Inc. 2015 Stock Incentive Plan in which she participated. The cash bonus agreement provided for a full releasedate of claims in favor of the Company, USPI Holdings Company, Inc. and their respective affiliates.grant (March 1, 2023).

Compensation Discussion & Analysis

|

The Company will disclose its achievement against the applicable performance metrics for the 2023 Performance-Based RSUs following completion of the three-year performance period. Results of 2021 LTI Awards The performance-based RSUs granted in February 2021 were divided into three equal one-year tranches, with performance in each year measured based on Adjusted EPS performance (weighted 50%) and Adjusted FCF Less NCI performance (weighted 50%), with a multiplier based on Relative TSR measured over the full three-year performance period that adjusts the total payout by +/- 25%. These grants vested in February 2024 following the HR Committee’s certification of the Company’s achievement under the performance metrics. | | | | | | | In addition, in February 2020, Ms. Karrmann was granted a cash-based long-term incentive award of $5,000,000, which was scheduled to vest in 20% increments on each of the first, second and third anniversaries of the grant date and 40% on the fourth anniversary, in each case, subject to her continued employment through such vesting dates. This award was granted in recognition of her strong performance at the Company and to encourage her long-term retention.2024 PROXY STATEMENT

In connection with her separation in October 2020, Ms. Karrmann forfeited the entirety of the cash-based long-term incentive award.

The Compensation Process

Role of the Human Resources Committee

| | 51 |

Compensation Discussion & Analysis

The following table shows the Company’s results under the 2021 performance-based RSUs over the three-year performance period ended December 31, 2023. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Performance Factor | | Threshold

(0%) | | | FY 2021

Target

(100%) | | | Maximum

(200%) | | | Threshold

(0%) | | | FY 2022

Target

(100%) | | Maximum

(200%) | | | Threshold

(0%) | | | FY 2023

Target

(100%) | | | Maximum

(200%) | | | | | | | | | | | | Adjusted EPS | | | $2.51 | | | | $4.17 | | | | $4.81 | | | | $5.86 | | | $6.45 | | | $7.05 | | | | $4.68 | | | | $5.27 | | | | $5.85 | | Result | | | | | | | $7.58 | | | | | | | | | | | $6.80 | | | | | | | | | | | $6.98 | | | | | | | | | | | | | | | | Adjusted FCF Less NCI | | | $35M | | | | $155M | | | | $245M | | | | $65M | | | $145M | | | $225M | | | | $660M | | | | $740M | | | | $820M | | Result | | | | | | | $641M | | | | | | | | | | | $(24)M | | | | | | | | | | | $1.183B | | | | | | | | | | | | | | | | Result | | | | | | | 200% | | | | | | | | | | | 79% | | | | | | | | | | | 200% | | | | | | | | Relative TSR Multiplier | | | (125% for 1st / 75% for 4th) | | Result | | | 1st Place – 125% multiplier | | | | | | | | | | | | Final Result | | | | | | | | | | | | | | | | | | 199.7% | | | | | | | | | | | | | | | | |